Freight Market Snapshot (10.13.25 - 10.19.25)

Van Rates: The van load-to-truck ratio declined 4.5%, indicating a slight softening in demand relative to available capacity. However, van spot rates rose 1.5%, suggesting that pricing momentum is beginning to recover even as capacity remains accessible. The rate increase points to improving demand conditions in select markets, supporting a more balanced environment.

Flatbed Rates: Flatbed load-to-truck ratios fell 7.4%, showing a modest easing in demand and a slight loosening in capacity. Flatbed spot rates held at 0.0%, signaling stable market conditions with limited pricing movement. Despite softer ratios, the segment remains steady, with capacity and demand largely aligned.

Reefer Rates: Reefer load-to-truck ratios increased 6.9%, marking stronger seasonal demand and tightening availability in the temperature-controlled segment. Reefer spot rates jumped 3.5%, reflecting renewed pricing strength as freight volumes pick up heading into late October.

Fuel Prices: Fuel prices declined 1.4% this week, providing carriers with moderate cost relief and supporting improved operating margins amid mixed market conditions.

CAPACITY TRENDS

· Van: Capacity loosened slightly, but firming rates indicate that underlying demand may be improving.

· Flatbed: Capacity remained broadly stable, with flat rates showing little pricing pressure despite lower ratios.

· Reefer: Capacity tightened as demand rose, supporting notable rate gains and signaling stronger seasonal activity.

MARKET OVERVIEW

This week’s freight market showed mixed signals, with spot load posts down 4.4% and truck posts down 1.4%, indicating a mild reduction in demand and available capacity. Van and flatbed activity softened, while reefers showed clear signs of tightening and rate recovery. With fuel prices down 1.4%, carriers are seeing modest cost relief, and rate strength in the reefer and van segments suggests the market may be stabilizing as seasonal demand builds.

Let's connect if you have questions about how these trends impact your freight strategy! Our team is here to help you navigate shifting conditions and optimize your supply chain.

Guaranteed Service backs every quote

✅ Fast, Accurate Quotes – Every rate is backed by a live truck for competitive and reliable pricing.

✔️ Seamless Shipment Tracking – Stay updated with automated notifications, check-ins, and real-time visibility via MacroPoint GPS tracking included on every load ( hand written Summary sent via email telling the whole story, the good and the bad )

✅ Full & Partial Load Solutions – Cost-effective options for FTL, partials, with LTL we offer an EDI (system that provides discounts with common LTL carriers instantly - typically used as a pricing tool, thereafter working with more viable owner operators )

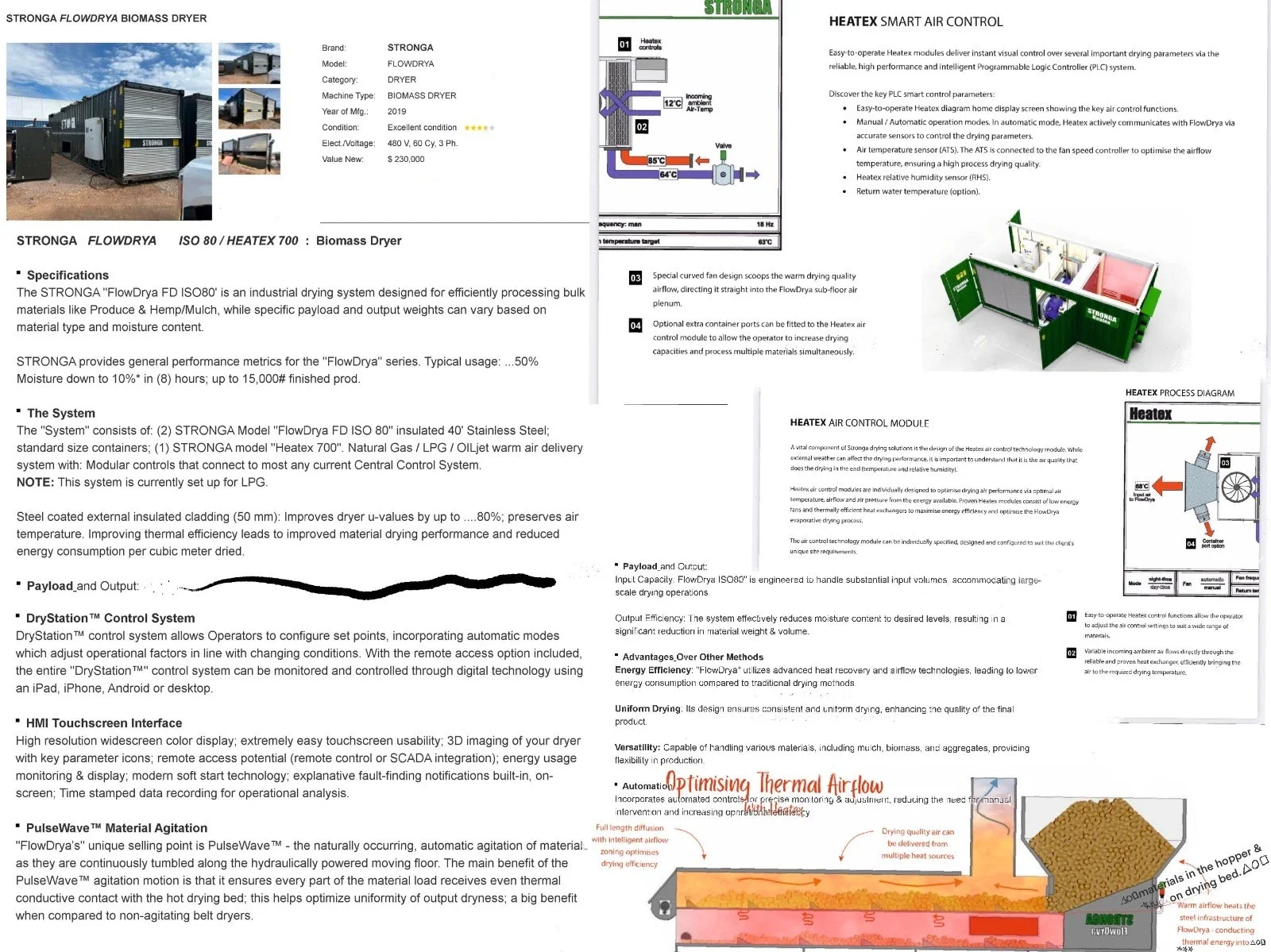

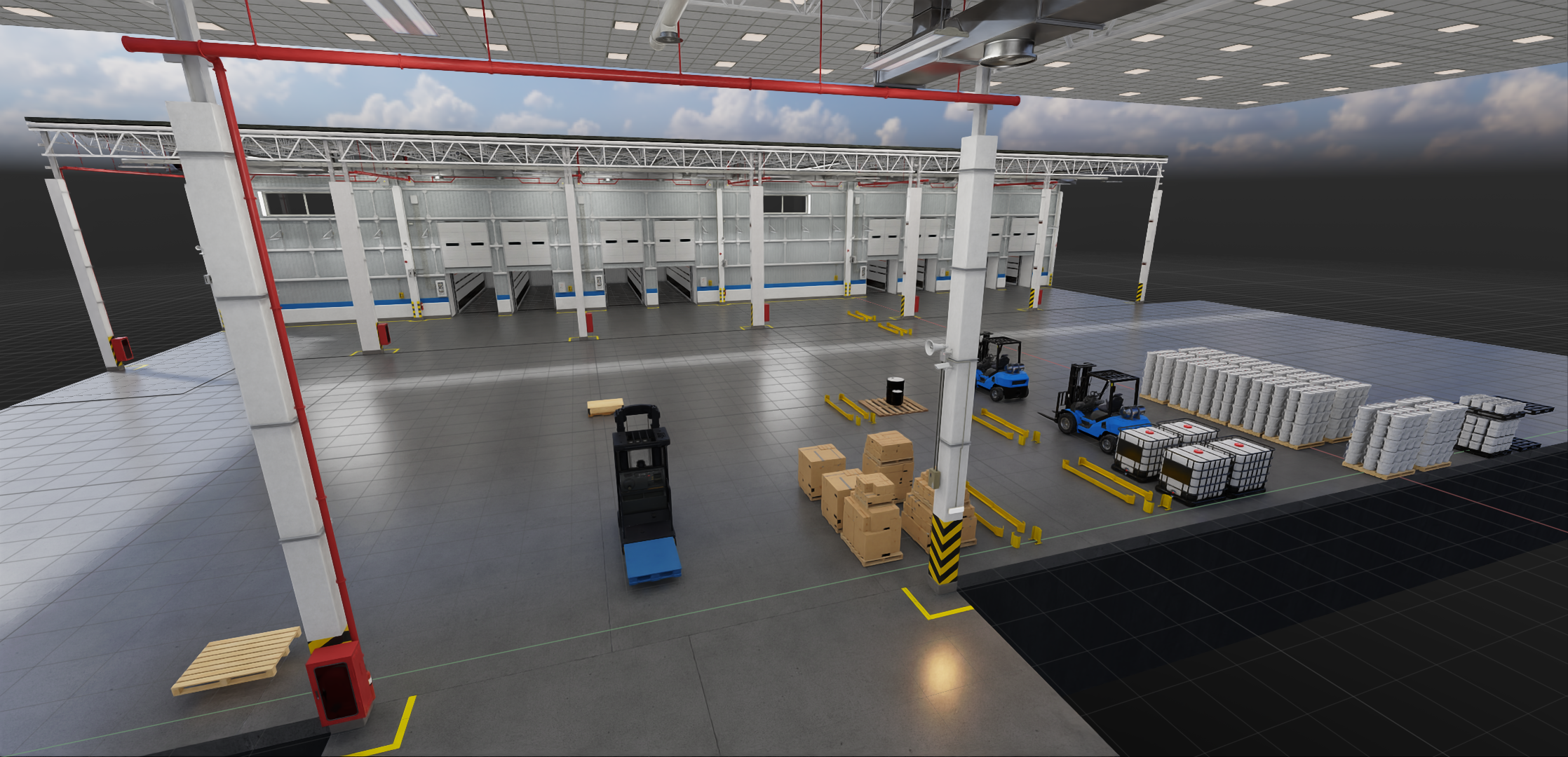

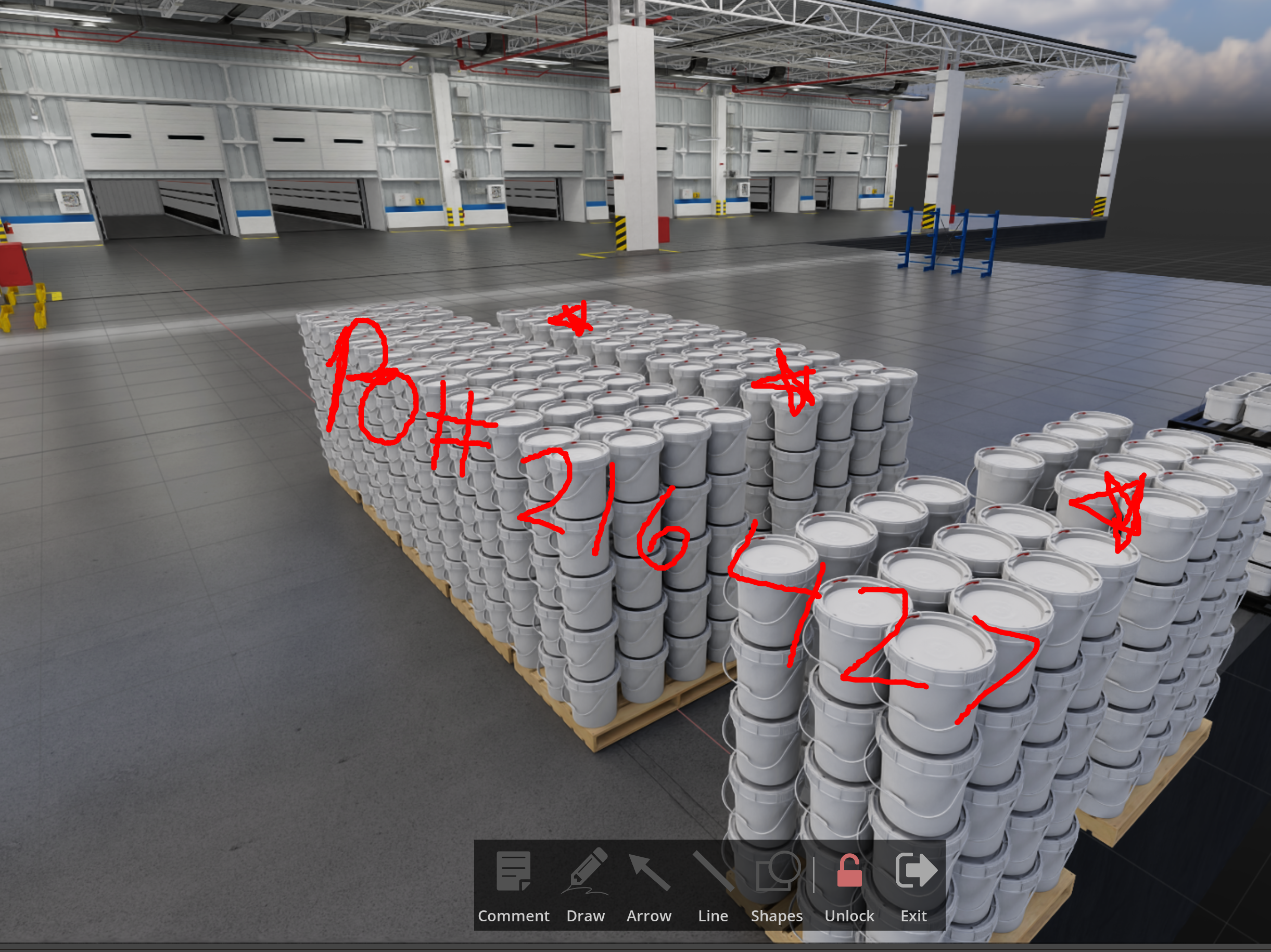

Special Projects & Real world visualizer

¶ Real world visualization via USD Explorer ( Nvidia Omniverse ) to help with warehousing storage and creating a better flow based on Supply and Demand - Outbound : Combine partial orders into one truck, displays how to re-layer pallets and improves loading/unloading efficiency. Inbound : Integrate sales/purchasing database with ICQA and determine highest IN/OUT SKU → remapping usable warehouse space to create more efficient flow, low moving sku’s or long term projects in Inbound/Receiving Area, high moving SKU’s closest to outbound dock and special scenarios like partial pallets stored in floor pick through area easily accessible. Class code mapping and rules for rack projects, save time on pick waves and know exactly what is in your warehouse top to bottom.